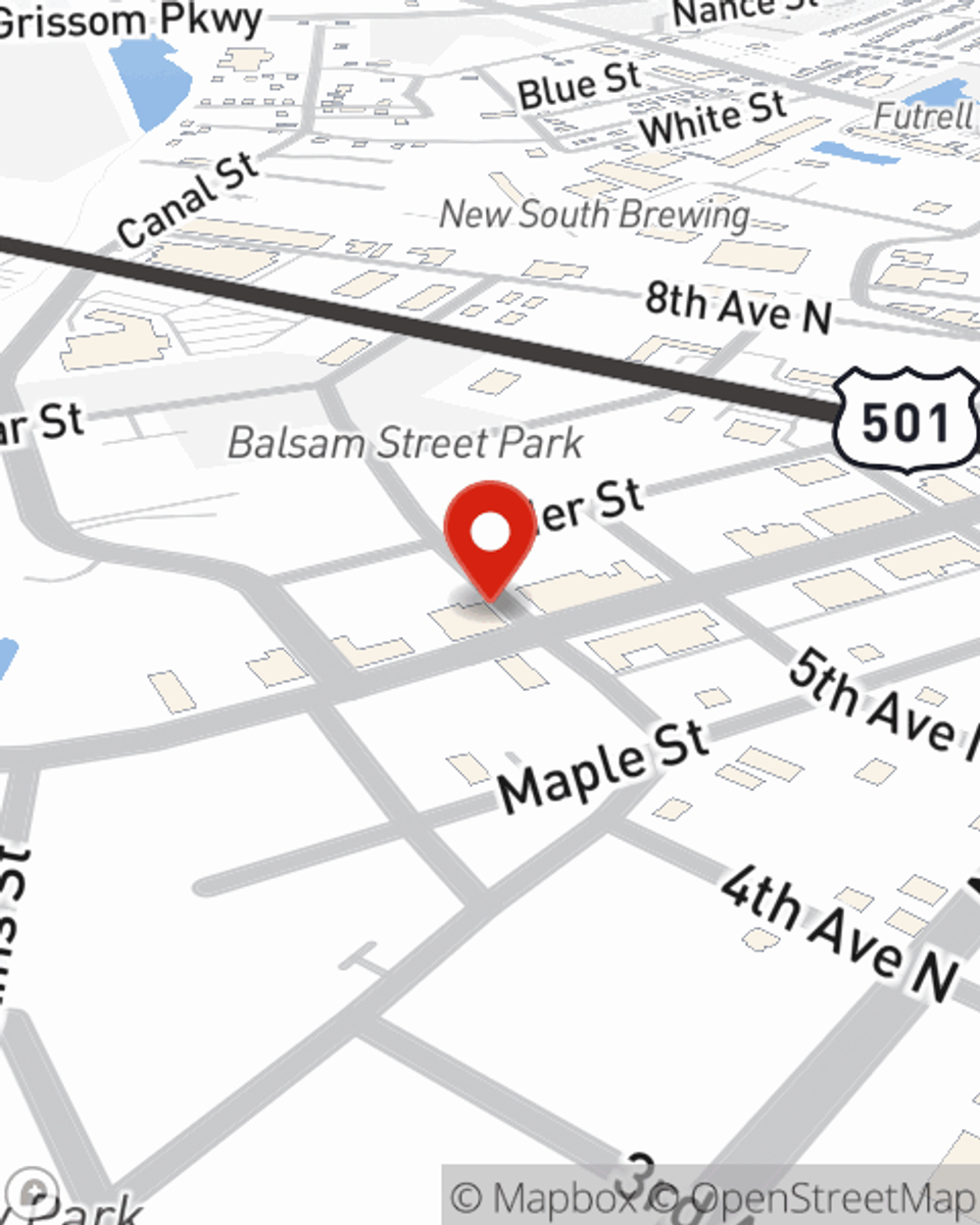

Condo Insurance in and around Myrtle Beach

Townhome owners of Myrtle Beach, State Farm has you covered.

Quality coverage for your condo and belongings inside

There’s No Place Like Home

Because your home is so special to you, it makes sense to want to protect against the unexpected, which could include situations or damage due to theft or hail. That's why State Farm offers coverage options that may be able to help protect your largest asset.

Townhome owners of Myrtle Beach, State Farm has you covered.

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

You can relax with State Farm's Condo Unitowners Insurance knowing you are prepared for the unpredictable with fantastic coverage that's right for you. State Farm agent Wade Davis can help you explore all the options, from liability, replacement costs to a Personal Price Plan®.

Fantastic coverage like this is why Myrtle Beach condo unitowners choose State Farm insurance. State Farm Agent Wade Davis can help offer options for the level of coverage you have in mind. If troubles like wind and hail damage, identity theft or drain backups find you, Agent Wade Davis can be there to assist you in submitting your claim.

Have More Questions About Condo Unitowners Insurance?

Call Wade at (843) 626-3545 or visit our FAQ page.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.